The aggressive move towards clean energy by India has received further traction with the introduction of the DREBP policy, as part of the Gujarat state Renewable Energy Policy. Intended to serve the purpose of enabling small investors and individuals, DREBP allows developers to develop solar projects of up to 5 MW (and wind under 10 MW).

The aggressive move towards clean energy by India has received further traction with the introduction of the DREBP policy as part of the Gujarat state Renewable Energy Policy. Intended to serve the purpose of enabling small investors and individuals, DREBP allows developers to develop solar projects of up to 5 MW (and wind under 10 MW) and sell power directly to state utilities through bilateral agreements, disregarding competitive bidding altogether. This breaks the administrative red tape and saves developers as well as power purchasers money.

Unlike large-scale solar tenders, DREBP offers a streamlined model tailored for decentralized power projects. Eligible solar farms enjoy priority grid connectivity and get Letters of Award automatically issued by DISCOMs or Gujarat Urja Vikas Nigam Ltd. (GUVNL) within 15 days, as per GERC Tariff Orders No. 5 & 6 of 2024. Power is procured at state-regulated tariffs—₹2.76/kWh levelized or ₹2.48/kWh net—eliminating the need for auctions. Such a bilateral procurement model, therefore, makes Gujarat a testing ground of decentralized solar growth where individuals, farming communities, and minor enterprises would be allowed to interface with India going green transition with definite regulatory assurance and financial certainty.

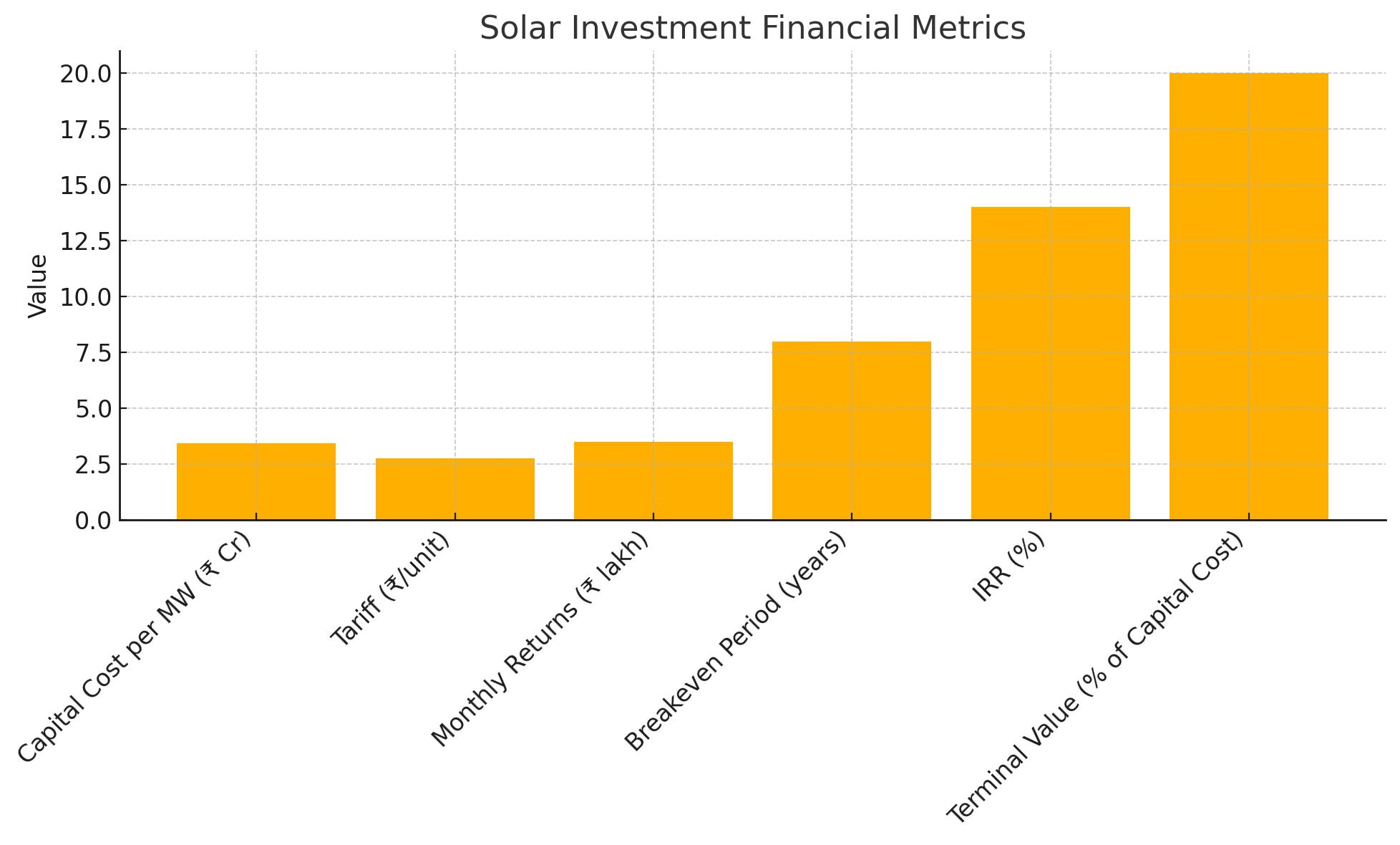

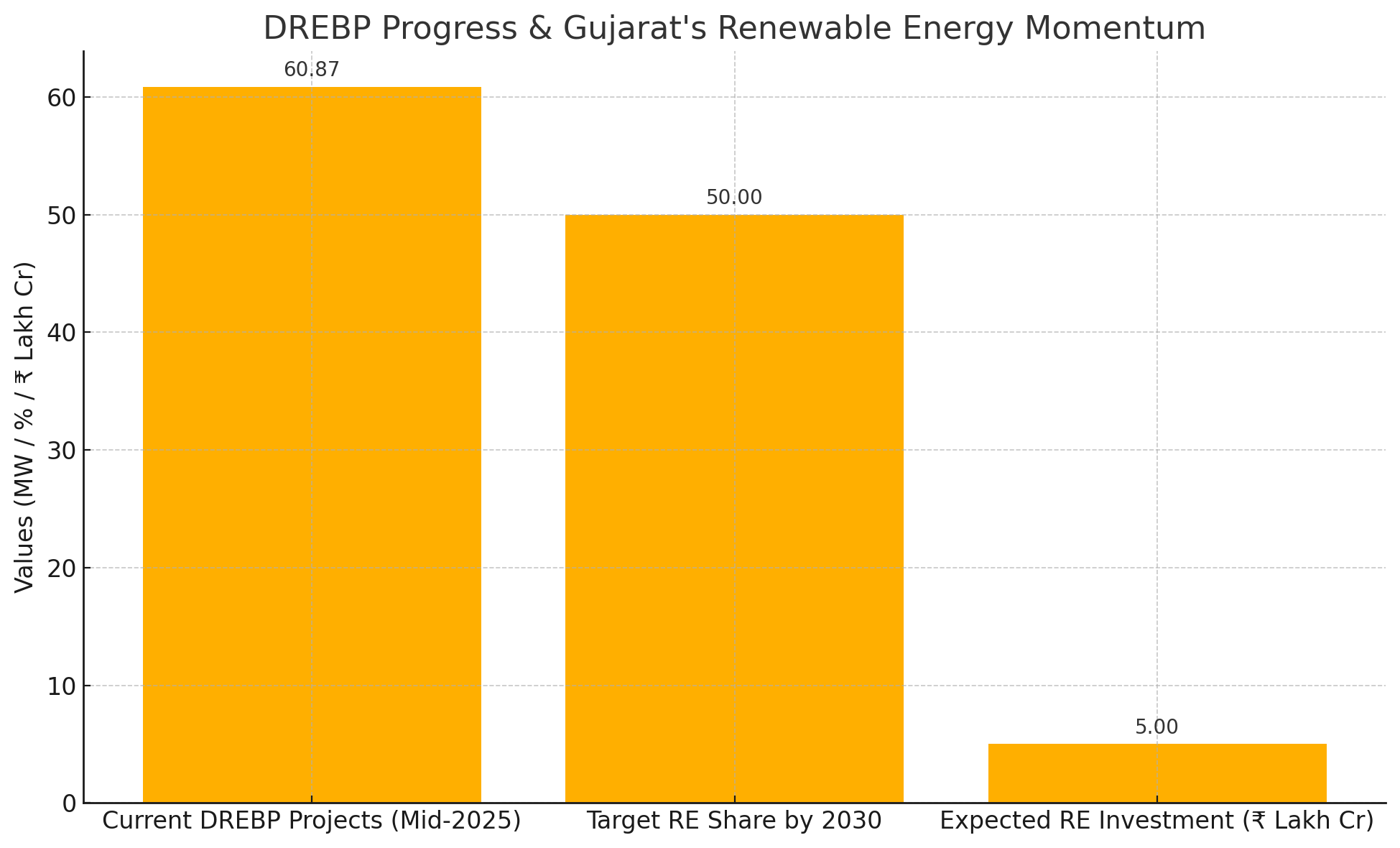

A notable example is the award of a 24.1 MW solar portfolio to Solex Green Energy, aggregating approximately ₹68.7 crore in contracts, scheduled for execution during FY 2025–26 in tranches. Similarly, KPI Green Energy’s subsidiary received LoAs totaling 36.87 MW under DREBP for captive power generation by various non-institutional clients. From an investor perspective, a 1 MW solar plant under the 100% equity model costs roughly ₹3.45 crore (including GST), with predictable revenues via a 25-year PPA at ₹2.76 per unit. Providers like KP Group estimate guaranteed monthly gross returns of ₹3.4-3.6 lakh during the initial years, followed by a terminal value guarantee equivalent to at least 20% of capital cost after 25 years. Internal rates of return are estimated above 14%, with breakeven in under 8 years. These conditions make DREBP attractive not only for traditional utility-scale developers but also for residents, cooperative societies, or farmers holding small parcels of land near substations.

Although DREBP is relatively new, Gujarat has already recorded significant traction. Solex Green Energy’s 24 MW order and KPI Green’s 36.87 MW project pipeline reflect growing interest by mid-2025. Underlying this surge is the Gujarat Renewable Energy Policy, aiming to achieve 50% renewable energy within the state by 2030—driving expected investments of approximately ₹5 lakh crore. Gujarat’s competitive regulatory framework—featuring simplified project onboarding, priority grid access, and clear tariff rules—has become a case study in accelerating distributed energy deployment at the grassroots.

DREBP creates a decentralized investment channel, but it rewards various parties. People and farmers who were unable to enter due to the extreme entry restrictions now have an opportunity to utilize their land and generate solar energy, and earn money from it. With distributed solar capacity, DISCOMs in turn can fulfill their Renewable Purchase Obligations (RPOs), de-stress the grid during peak hours, and cut transmission losses. The fixed PPA structure also ensures long-term stability for developers and off-takers, while bypassing competitive auctions ensures SPEED—deployments can be completed much faster with fewer procedural delays.

Regardless of an early success, there are obstacles to overcome. Some regions have grid infrastructure constraints around substations that hinder the possible capacity of distributed projects. In addition, state backing outside of Gujarat has yet to take on a bilateral procurement approach on a similar scale, restricting the venturing of DREBP on its national validation. Tariff certainty is connected to financial viability; with revisions to expected movements, tariffs downward, it can have an influence on potential returns. Moreover, small investors might not be well placed to handle operations and maintenance of projects, especially when they are not advised or assisted by external service providers.

Other states in India may want to emulate the approach taken by Gujarat state to be inspirational to DREBP to be replicated in other states within the country. They should implement transparent tariff orders, permit expediting the issuance of LoA, streamline the connectivity, and integrate the PPA commitment with utilities. Substations may be surrounded by decentralized energy zones that would encourage the input of individual and local investors. Adding to this, funding products they are geared towards small developers like 30-40% down payment loans, pooled financing mechanisms or cooperative ownership can increase involvement beyond the usual solar businesses. DISCOMs might facilitate the technical support and O&M structures as well to keep projects productive during the 25-year PPA.

In a country where grid challenges, land fragmentation, and energy poverty persist, DREBP represents a compelling model- modular, scalable, and inclusive renewable energy deployment. Gujarat’s early experience shows that when the policy environment is hospitable, decentralized solar can thrive fast—even under portfolios of 20–50 MW spread across dozens of small land owners. Going forward, DREBP could become a template for India’s rural solar revolution, helping farmers monetize idle land, utilities meet RPOs efficiently, and the grid integrate clean power across regions. Success will hinge on replicability, availability of finance, local capacity building, and supportive state-level regulations beyond Gujarat. significant traction. Solex Green Energy’s 24 MW order and KPI Green’s 36.87 MW project pipeline reflect growing interest by mid-2025. Underlying this surge is the Gujarat Renewable Energy Policy, aiming to achieve 50% renewable energy within the state by 2030—driving expected investments of approximately ₹5 lakh crore. Gujarat’s competitive regulatory framework—featuring simplified project onboarding, priority grid access, and clear tariff rules—has become a case study in accelerating distributed energy deployment at the grassroots.

DREBP is a positive new development in the solar policy environment in India. DREBP is capable of fast-tracking the deployment of solar energy by enabling small-scale investors, opening up near-station land, and offering transparent PPAs without the red-tape of auctions. Gujarat has demonstrated that such distributed models can scale rapidly, attract an investment of between 3 and 4 crore per MW, and generate returns of more than 14 per cent as it helps the state to meet clean energy targets. With other states adopting the same clear tariffs, permitting process, and financing supports, DREBP can become one of the key stories in the Indian clean energy transition-where individuals or farmers can also help in reaching the 500GW 2030 clean energy target. Disclaimer: This article has been prepared by https://thesolarcart.com based on publicly available information, industry reports, & independent research. While every effort has been made to ensure accuracy and reliability, we make no warranties or representations regarding the completeness or current relevance of the information. Readers are encouraged to verify details independently before making any investment or policy decisions.